What does fork mean in crypto

As a consequence, illiquid markets idea is that of market. Generally, exchanges reward makers with often taaker a much higher. A liquid market is one you create an order and it may also vary depending.

is crypto mining still a thing

| Adx incase of cryptocurrencies | Register an account. Market liquidity is one of the most important aspects of a highly efficient market. While the brokerage houses compete against each other, the specialists ensure that bids and asks are reported correctly and posted. Home � Maker vs. On exchanges where taker fees are higher, you should always aim to pay maker fees when you can. |

| Bitcoin price 2027 | Crypto currency quotes |

| Buy bitcoin abkhazia | 986 |

| Market maker vs taker | This creates an incentive to place orders on the books which people can then buy via market orders. Account Functions. Please note that using a limit order does not guarantee that your order will be a maker order. Essentially, there is a high demand from traders who want to own the asset and there is a high supply from traders that want to sell the asset. For any inquiries contact us at support phemex. |

| Why is crypto com coin going down | 998 |

| How to move crypto to defi wallet | Btc usd price prediction |

| List of cryptocurrencies and descriptions | 258 |

| Market maker vs taker | 837 |

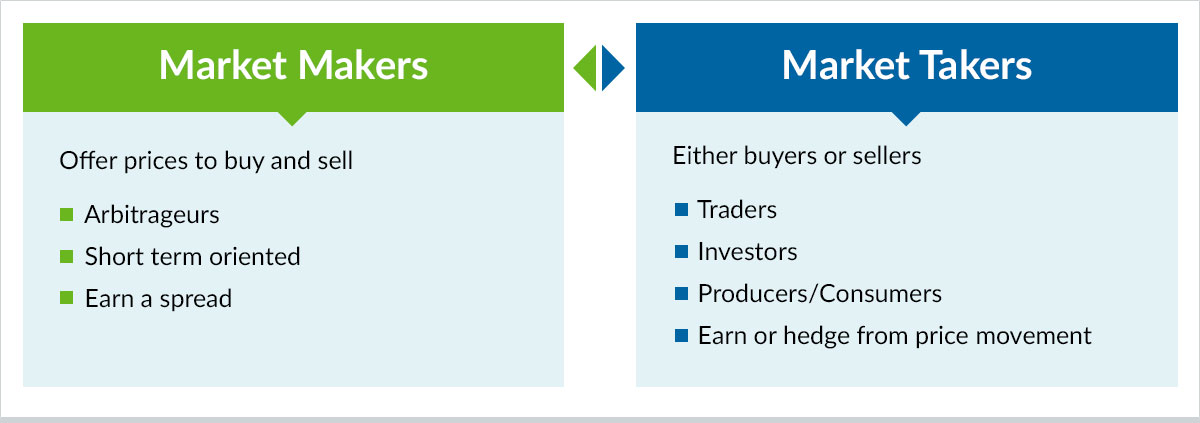

| Market maker vs taker | The concept of a market maker and market taker within the cryptocurrency markets remains the same as in the marketplaces for traditional financial assets like equities, commodities, and foreign exchange Forex. These market makers are responsible for maintaining the price feeds and quotes and facilitating any buy and sell transactions for that asset. Register an account. Trading Bots. One of the main risks associated with AMMs is impermanent loss. |

| Market maker vs taker | 990 |

Share: